EASE OF USE & PRACTICAL EXAMPLES

AI in insurance – explained simply.

QUESTIONS & ANSWERS

1. Fundamentals of Artificial Intelligence

Artificial intelligence is software that performs tasks that previously required human thinking – e.g., understanding texts, analyzing data, or suggesting decisions.

Insurers benefit from this because AI can quickly recognize and evaluate large amounts of information and derive meaningful courses of action from it.AI is the umbrella term for intelligent systems.

Machine Learning (ML) refers to models that learn from data.

Large Language Models (LLMs) are AI systems that understand, structure, and interpret language.

LLMs are particularly valuable to insurers because they can professionally understand texts such as claims reports, expert opinions or emails.Because AI is now ready for practical use :

She works quickly and precisely.

She can take on complex specialist tasks.

It drastically reduces costs and processing times.

This opens up enormous potential for savings, particularly in the insurance industry.Classic software follows rigid rules.

AI interprets content, draws conclusions, and adapts to new data.

For insurers, this means:

An AI automatically detects coverage gaps, damages, risks, or necessary documents – without manually predefined rules.

QUESTIONS & ANSWERS

2. Benefits & Potential for Insurers

Up to 40% lower processing costs

Up to 70% shorter lead times

Fewer errors

Improved customer satisfaction

Higher productivity

Claims management (photo, video, text)

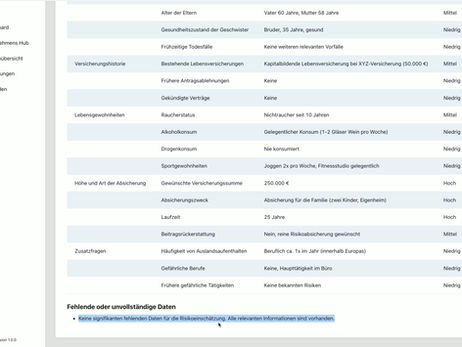

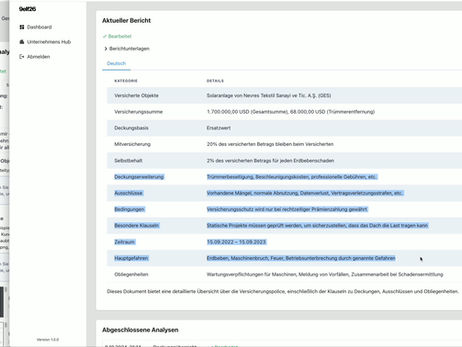

Underwriting and risk assessment

Contract amendments (inclusions, exclusions, cancellations)

Customer service / Email/document interpretation

Fraud detection

Building and inventory analysis

Analyze documents

Conduct coverage checks

Estimate damage costs

Suggest action steps

Extract data

Prioritizing processes

Rapid analysis of customer data

Preparation of risk reports

Automated responses

Support with consulting and sales

Efficient document processing

QUESTIONS & ANSWERS

3. Practical Use Cases in the Insurance Industry

AI can:

Analyze damage patterns

Identifying fraud patterns

Check coverage

Provide reserve suggestions

Payout recommendations

Request documents automatically

Risk assessment based on all available data

Building valuations (including 3D scan)

Scoring and risk recommendations

Comparison with reference conditions

The AI reads the request, e.g.:

"Please remove person X from the contract."

→ It recognizes the process, contract type, necessary steps, and data fields.

→ The clerk only needs to confirm.Pre-sorting of emails

Suggested answers

Recognition of the business transaction

Assignment to teams

Document completeness check

QUESTIONS & ANSWERS

4. Start and introduction in the company

Select a small, clear use case

Define data paths

Launch first pilot environment

Measuring results

Scaling

With 9elf26.ai, a pilot project often only takes 4–6 weeks.

Transparency regarding goals

Simple training courses

Clearly define roles

Involving employees in pilot phases

Take concerns seriously (“AI doesn’t replace – it relieves”)

Projects that are too large

Lack of clear goals

No process owner

No testing strategy

Unclear data quality

No – but you need:

Process knowledge

Expert decision-makers

IT contact person

The platform handles the complex AI functions (e.g., 9elf26.ai).

AI for your insurance processes

Central AI platform for property, life, and health insurers

QUESTIONS & ANSWERS

5. Integration into systems & processes

Via APIs or batch processes.

9elf26.ai is compatible with systems such as:Inventory management systems (e.g. V'ger, Guidewire, msg, adesso)

Third-party systems (CRM, claims portals)

Document management systems

For example:

Documents

Emails

Images/Videos

Master data

Conditions

The AI does not require any special formats – PDFs, JPGs, DOCX or structured data are sufficient.

Technical tests

End-to-end tests

Versioning (e.g., every prompt and every model is historized)

Monitoring of results

Quality metrics

The AI recognizes the process → classifies it → suggests measures → automatically executes work steps.

The human confirms or corrects.

Human + AI result in maximum process quality.

QUESTIONS & ANSWERS

6. Security, Regulation & Governance

Yes.

However, insurers must take note:EU AI Act

GDPR

BaFin requirements for traceability

9elf26.ai meets all relevant requirements.

Processing in Europe

No data storage without consent

Pseudonymization

Audit trails

Encryption

Yes.

The platform shows:Which input data was used

Which rules were applied?

What results were produced?

This is essential for regulation and quality.

AI Manager

Quality management

AI usage policy

Monitoring & feedback loops

QUESTIONS & ANSWERS

7. Economic efficiency & strategic importance

Many projects achieve positive effects after just 3–6 months:

Less processing time

Lower administrative costs

Better completion rates

Fewer follow-up questions

Clerks are relieved of routine tasks.

Work is becoming more technical, less administrative.

AI provides decision suggestions, not final decisions.

Faster processes

Higher customer satisfaction

Lower cost base

Access to more automation

Competitive advantages

Yes, in the long term:

Pay-per-use

Prevention instead of reaction

Automated risk scoring models

Faster product development

QUESTIONS & ANSWERS

8. Specifically regarding 9elf26.ai

A fully operational AI platform for insurers, brokers and service providers.

It combines state-of-the-art AI with over 30 years of experience in insurance IT.Claims management

Coverage analysis

Contract processes

Risk assessment

3D building analysis

Inventory lists

Customer communication

Focus on insurance processes

Ready-to-use AI modules

High level of expertise

Direct integration

Transparent Governance

Low costs, fast results

German/European Compliance

That depends on the use case. In principle, existing standard data is sufficient, e.g.:

-

Claims: damage report, policy/contract, conditions, optional images/receipts or audio.

-

Underwriting: application/policy, existing property/building documents, optional photos/damage history

Supported formats: .pdf, .doc, .docx, .jpg, .jpeg, .png, .wav, .mp3, .txt, .xls, .xlsx, .json, .eml, .msg

-

9elf26.ai runs exclusively in your cloud on AWS or Azure.

We use EU-compliant LLMs – operation and data processing take place in EU regions. Data sovereignty always remains with the insurer.We work with a certified security and compliance framework.

This ensures that AI use, data processing, and operations are verifiable, traceable, and regulatory compliant—both in the pilot phase and later in the rollout.

In this way, we support your requirements under the AI Act, DORA, and GDPR.9elf26.ai integrates easily and without modification:

-

REST API for real-time processes

-

Batch/jobs for mass operations

There is also an upload interface for administrators.

Results are returned in a structured format (e.g., coverage + justification, next steps, routing, reserve, fraud, recourse) and can be transferred to the core system via API.

-

In the pilot, we measure exactly what we promise—with baseline and random samples together with your specialist team.

Typical target KPIs:

-

Processing time per case: −50 to −70%

-

Processing costs per case: −30 to −40%

-

Dark regulation/automation: +15 to +30%

-

Queries/additional claims: −20 to −40%

-

Hit rate for document/coverage interpretation: >90% (sampling)

All results are transparently documented and transparent.

-

We start with a fixed-price pilot (6 weeks), clear scope, and real sample.

Rollout only if KPIs are successful. The pricing model scales according to volume.

Result: business case + rollout roadmap.